Overall Ranking

4.5/5

Overview

5/5

4/5

4/5

5/5

The Chime Credit Builder Visa® Credit Card, a secured credit card, works like a debit card and helps those with poor credit or no credit build a credit rating just like a credit card.

Editor's Note

You can trust the integrity of our balanced, independent financial advice. We may, however, receive compensation from the issuers of some products mentioned in this article. Opinions are the author's alone. This content has not been provided by, reviewed, approved or endorsed by any advertiser, unless otherwise noted below.

Secured Chime Credit Builder Visa® Credit Card Review

There are a growing number of credit builder loans and credit builder credit cards available on the market today. But how many come with a 0% APR and no fees? As it turns out, there is one – the Secured Chime Credit Builder Visa® Credit Card.

The card does not require a security deposit or a credit check to qualify for it. If you’re looking to build or rebuild your credit, the Chime Credit Builder Secured Visa® Credit Card may be the account to get started with.

About Chime®

Chime* is a financial technology company whose mission is to provide basic financial services that are “helpful, easy, and free”. Through its award-winning financial app and debit card, Chime provides a broad range of services including a Chime® Checking Account, a Credit Builder Account, and a Savings Account.

Chime proudly states that its business model does not rely on overdraft fees, minimum balance requirements, or monthly fees.

What Chime Secured Credit Builder Visa® Credit Card Offers

The Secured Chime Credit Builder Visa® Credit Card works like a Visa debit card and helps you build your credit rating just like a credit card.

Chime specializes in working with those who have poor credit or no credit at all. They offer savings and checking accounts specifically for consumers who have credit issues. Chime can do this because they don’t run a credit check on consumers, nor do they pull a ChexSystems report to investigate negative impacts from your past. It should come as no surprise that they offer the Chime Credit Builder Secured Visa® Credit Card for the same purpose.

Related: ChexSystems: The Banks’ Secret WatchDog is Watching You

How the Chime Credit Builder Secured Visa® Credit Card Works

You’ll first need to open an account through Chime to have a credit card. Chime offers a checking account as well as the Chime Savings Account, which is currently paying 2.00% Annual Percentage Yield (APY)^ - 8x the national average+ on all balances.

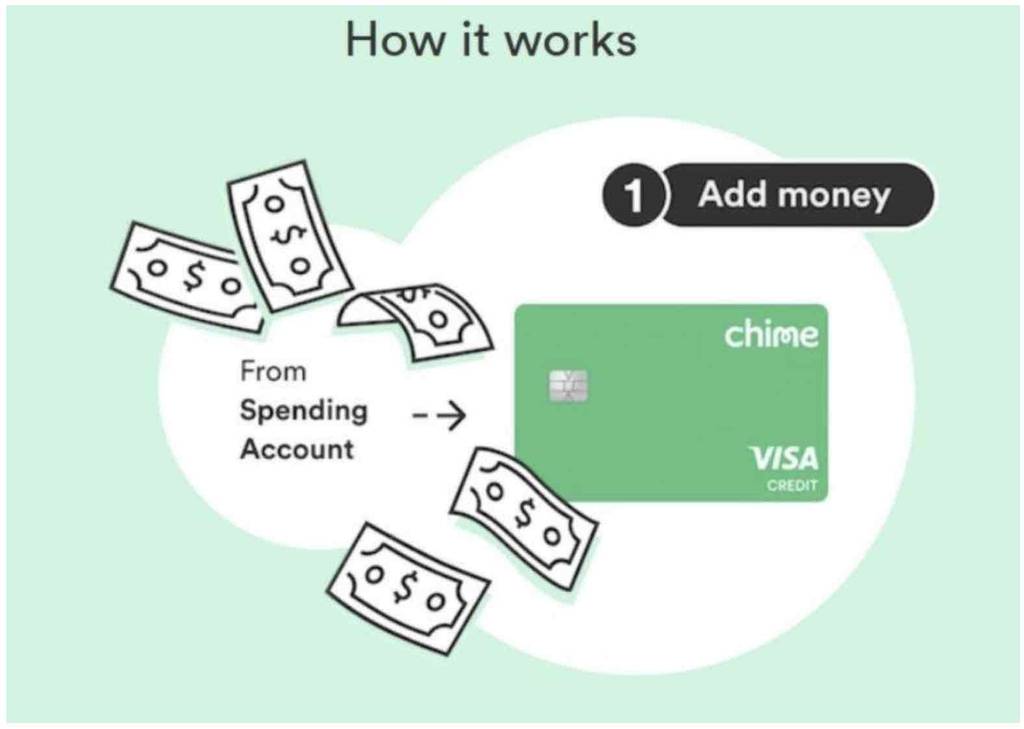

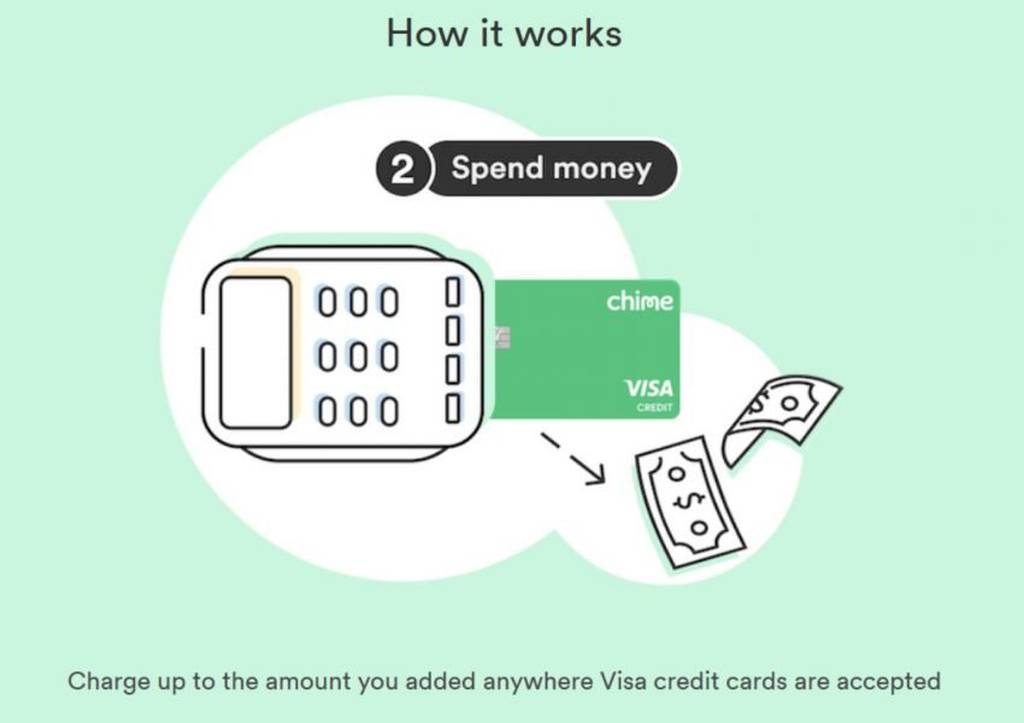

The Chime Credit Builder Visa® Credit Card, a secured credit card, is a Visa credit card allowing you to control how much you spend on the card by transferring funds from your Chime® Checking Account to a special account. This is called the Credit Builder Secured Account. You can charge any amount up to the limit in the secured card account. In this way, the Chime Credit Builder Card functions more like a debit card than a credit card. You can replenish your secured account at any time with the funds from your Chime Checking Account, thus “reloading” your Chime Secured Credit Builder Visa® Credit Card.

And since the Chime Credit Builder Secured Visa® Credit Card is a Visa credit card, it is welcomed wherever Visa is accepted.

But it’s even less restrictive than that. You can use the Chime Credit Builder Secured Visa® Credit Card to make regular purchases out of your Chime Checking Account. At the end of the month, the Chime Safer Credit Builder automatically pays off the credit card balance from the Secured Account.

And here’s where the Chime card acts more like a credit card: After the credit card balance is paid off automatically, Chime reports the credit card payment to all three major credit bureaus – Experian, Equifax, and TransUnion. This helps you to build or rebuild your credit standing.

As you might expect from a credit-builder account, Secured Chime Credit Builder Visa® Credit Card doesn’t offer the rewards and perks that come with a traditional credit card for those with good or excellent credit. There’s no sign-up bonus, no rewards program, and no additional benefits, such as an auto rental collision damage waiver. It’s strictly a card designed to help you build or improve your credit score.

Credit score improvement: Secured Chime Credit Builder Visa® Credit Card has helped users increase their credit scores by an average of 30 points, while also enabling 95% of members with no credit history at all to get a credit score for the first time.

Features and Benefits of Chime Credit Builder

The Secured Chime Credit Builder Visa® Credit Card offers the following features and benefits:

No Interest or Fees

Chime Credit Builder Account, which can be managed from the Chime Mobile app available on Google Play for Android devices 5.0 and up, and on the App Store for iOS devices, 11.0 and later, has no monthly or annual fees and 0% APY (annual percentage yield).

There are no qualifications: Chime will not pull a credit report and give this card to those with bad credit or no credit.

Controlled Limits

Your credit limit is determined by the amount of money you have available to spend in your Chime Credit Builder Account, which can vary from month to month.

Since there is no credit limit connected to your Secured Chime Credit Builder Visa® Credit Card, you’ll never be in danger of having a high credit utilization ratio due to having a high outstanding balance against your established credit limit. That removes one more factor that could potentially hurt your credit score (credit utilization is the second biggest factor affecting your credit score, accounting for up to 30% of your score).

“Available to Spend” Feature

Spending authorization within your Secured Chime Credit Builder Visa® Credit Card is determined by the money you’ve added to your Credit Builder account, less any amounts you charge on the Visa card. You can increase the Available to Spend amount at any time by moving money from your Chime Checking Account into your Credit Builder account. That puts you in full control of the credit limit in your account. And equally important, the transfers take place in no more than 60 seconds.

“Move My Pay” Feature

This is an optional feature allowing you to move an amount you choose from your Chime Checking Account to your Credit Builder every payday. That gives you the ability to immediately increase your credit limit each time you’re paid. What’s more, you can move money back from the Credit Builder Account to the Chime Checking Account, should that become necessary.

“Safer Credit Building” Feature

There are three ways you can pay off your Credit Builder account each month. The first is to use manual payments, transferring funds directly to your Credit Builder account from your Chime Checking Account.

The second is to use ACH payments from any bank in the Credit Builder Account.

But the third option, and one that’s highly recommended, is to turn on the Safer Credit Building feature. In that way, Chime uses the money you’ve already added to your Credit Builder account to cover your credit card charges each month.

How to Sign Up for the Secured Chime Credit Builder Visa® Card

You need to have a Chime Checking Account to open the Chime Credit Builder. You can apply for a Chime Checking Account in as little as 2 minutes and you can even complete the process on your smartphone. You’ll start by entering your email. You’ll need to provide identifying information that is a typical requirement for all financial accounts. That may include a copy of your driver’s license and any other documentation needed to establish your identity.

Other information you should expect to provide includes the following:

- Your full name

- Email address

- Home address

- Your phone number

- Your date of birth

- A valid Social Security number

Once your account is open, you can link it to your bank account, or even fund it with payroll deposits.

Once again, one of the major advantages of Chime is that they don’t pull your credit report, nor do they run your name through ChexSystems. Its financial app is set up specifically to work with those who have either poor credit or no credit at all.

Once your Chime Checking Account is open, you’ll need a qualifying direct deposit of $200¹ or more within the previous 45 days.

Chime Secured Credit Builder Visa® Credit Card Interest Rates and Fees

| Annual Fee | $0 |

| Annual Percentage Rate (APR) | 0% |

| Cash Advance APR | N/A |

| Penalty APR | N/A |

| Cash Advance Fee | N/A |

| 0% Introductory APR | N/A |

| Balance Transfer Fee | N/A |

| Foreign Transaction Fees | None |

| Late Payment or Return Payment Fee | N/A |

| Overlimit Fee | None, but additional charges will be declined. |

| Minimum monthly payment | The full amount of your Credit Builder Account balance at the end of each billing cycle. |

| Payment due dates | 23rd |

Chime Secured Credit Builder Visa® Credit Card Pros and Cons

No Banking History Review — Chime doesn’t verify your banking history through ChexSystems. Even if you’ve had an unsatisfactory relationship with a financial service provider in the past, it won’t hurt your application with Chime.

No Credit Check — No credit check is performed when you apply for the Secured Chime Credit Builder Visa® Credit Card. In fact, your credit history – or the lack of it – won’t be a factor at all.

No Fees — Chime does not charge any monthly or services fees. No security deposit is required and there is no interest charged in connection with your Secured Chime Credit Builder Visa® Credit Card.

Positive Credit Reporting — Chime reports your payment history to all three major credit bureaus, giving you an opportunity to build or rebuild your credit with all three agencies.

Avoiding Late Fees — There is an automatic monthly payment feature that will prevent you from ever making a late payment.

Must Open An Account Through Chime — You are required to open a Chime Checking Account to be eligible for the Secured Chime Credit Builder Visa® Credit Card.

No Sign-up Bonus — Unlike credit cards for those with good or excellent credit, and even a few credit builder cards, the card does not offer a sign-up bonus or a rewards program.

Building Good Credit Habits

The Secured Chime Credit Builder Visa® Credit Card effectively “automates” many of the processes that go toward building good credit. This can be a great thing, but it’s also necessary to be aware of the dangers associated with “automated” credit management. Chime is assisting users through the difficult process of building credit. The danger, and the primary word of warning that we’ll give, is that the Secured Chime Credit Builder Visa® Credit Card doesn’t facilitate customers building these habits themselves.

So, while the Secured Chime Credit Builder Visa® Credit Card can be a fantastic tool for helping customers climb out of poor credit, they also need to be diligent in understanding how to keep this good credit going forward. Because, once they stop using the card, it all becomes more difficult.

Here are some habits we recommend to build and maintain good credit:

- Set a Schedule for Paying Obligations: One of the most important factors in building credit is paying your debts on time. Late payments are one of the most influential factors on your credit rating. We recommend setting a schedule for paying your monthly bills/debts and paying them all at once. Pick a day and time that works for you, and stick to it. Turning routines into habits is one of the most reliable ways to stay on top of obligations, and it also saves you time knowing that everything gets done at once.

- Credit Utilization Ratio: Your Chime Credit Builder Account works to automatically maintain your credit utilization for you, as your credit limit is determined by the amount in your secured account. Once you stop using this card, you’ll have to worry about this ratio yourself. A credit utilization ratio is the percentage of your credit limit that you have spent. A higher utilization ratio leads to a worse credit rating. Ideally, you want your credit utilization ratio below 30% at all times, and this is achieved by careful spending and budgeting.

Alternatives to the Secured Chime Credit Builder Visa® Credit Card

You can use several products in conjunction with Chime to improve your credit, including:

Milestone® Mastercard®

If you have poor credit and want to obtain a standalone credit card, you can check out the Milestone Mastercard®. The card doesn’t offer rewards, and the APR is high at 35.9%. What’s more, they charge an annual fee that can range from $175 the first year; $49 thereafter, which is a decent chunk of the typical $700 credit limit you’ll start with. However, if you’re unable to obtain a credit card anywhere else, this is a solid option to get started with.

Experian Boost™

A product that can be used in conjunction with the Chime Credit Builder Card is . Experian offers several credit monitoring services, but if you’re mostly interested in increasing your credit score, Experian Boost™ is an option. It can be particularly valuable for those who have very little credit or even none at all. What Experian Boost™ does is reflect non-lending payments, like your cell phone and utility bills on your credit report. They are then able to use your payment history with those vendors to build a credit score. You can build or increase your score in a matter of minutes.

Read More: Experian Boost™ Review

myFICO

Get your FICO score and learn more about tracking your credit with myFICO.

Another supplemental product is myFICO. Since it’s provided by the company that is behind FICO scores, you can consider it to be the source for all things credit score-related. They have various plans offered where you can monitor your credit at any level you choose. That includes everything from getting a single credit report from all three credit bureaus, to regular updates on both your reports and credit scores from all three bureaus regularly, as well as identity theft monitoring and protection.

Learn More: A Review of myFICO

FAQs

Do I need to open a Chime Checking Account to take advantage of the Secured Chime Credit Builder Visa® Credit Card?

Yes. The Chime Spending Account is the basic account required for a business relationship with Chime. In addition, it’s the account from which your Chime Credit Builder Card payments are made, and how the spending credit limit on the card is established. You cannot open a Chime Credit Builder Secured Visa® Credit Card unless you also have a Chime Spending Account.

Is it possible to make a late payment with the Secured Chime Credit Builder Visa® Credit Card?

Unfortunately, yes. Your monthly payment will be due on the 23rd of each month. If you miss a payment, your Credit Builder Card will be disabled and you’ll be asked to pay the overdue balance using the money you’ve added to your Credit Builder account, an ACH transfer, or transfers from your Chime Spending account. Once the funds have been transferred, your Credit Builder Card will be restored. However, if your balance isn’t paid in full after 30 days, the delinquency will be reported to all three major credit bureaus. It should go without saying that a late payment on a credit builder account will defeat the purpose of having the card in the first place.

On one hand you say that the Chime Credit Builder Card doesn’t require a security deposit, but on the other you confirm that it is a secured account. Isn’t that a contradiction?

Technically speaking, no. Categorically, the Secured Chime Credit Builder Visa® Credit Card does not require a security deposit, as is typical with many credit builder type loans and credit cards. But your card is fully secured by your Credit Builder account, and the funds are transferred into it from your Spending Account. In a real way, the Chime Credit Builder Card is only loosely secured. You don’t have to put up a specific amount of money, nor do you have to tie it up for a year or more before the funds are released. Instead, you can use the securing amounts to adjust the credit limit based on your own needs and ability.

Is the Secured Chime Credit Builder Visa® Credit Card a secured credit card?

Yes, the Chime card is a secured credit card. It is secured by your secured account with Chime, and the money that is moved onto the card from this account limits how much you can spend with the card.

Bottom Line

If you’ve had difficulty getting a credit card, either because you have no credit or bad credit, the Secured Chime Credit Builder Visa® Credit Card is a go-to solution. Since they don’t pull a credit report or even review your prior financial history, anyone can open an account. And all you need to do to get the credit card is to open a Chime Checking Account and get on the Waitlist for the Secured Chime Credit Builder Visa® Credit Card.

Once you do, you’ll be in line to have a Visa card that can be used anywhere Visa is accepted, with a credit limit that’s completely within your control. What’s more, the card comes with a 0% APR and no fees. That makes it the perfect no-cost way to begin building or improving your credit. Sign up for the Secured Chime Credit Builder Visa® Credit Card Waitlist today.