Life insurance is one of those necessary evils in our lives. Much like all insurance products, many of us need it, but we want to pay as little as possible.

It’s also a great example of what I call “painless ways to save money.” If you can lower your life insurance premiums, it gives you an opportunity to reduce your monthly expenses without changing the way you live.

So today, I’ve pulled together seven ways you can pay less for life insurance.

1. Reconsider How Much Life Insurance You Need

First, take a good hard look at your finances and determine exactly how much life insurance you need. Consider the expenses your spouse or other dependents will be left with if you were to pass away unexpectedly. If you’re trying to cut costs, there’s no reason to buy more coverage than you really need.

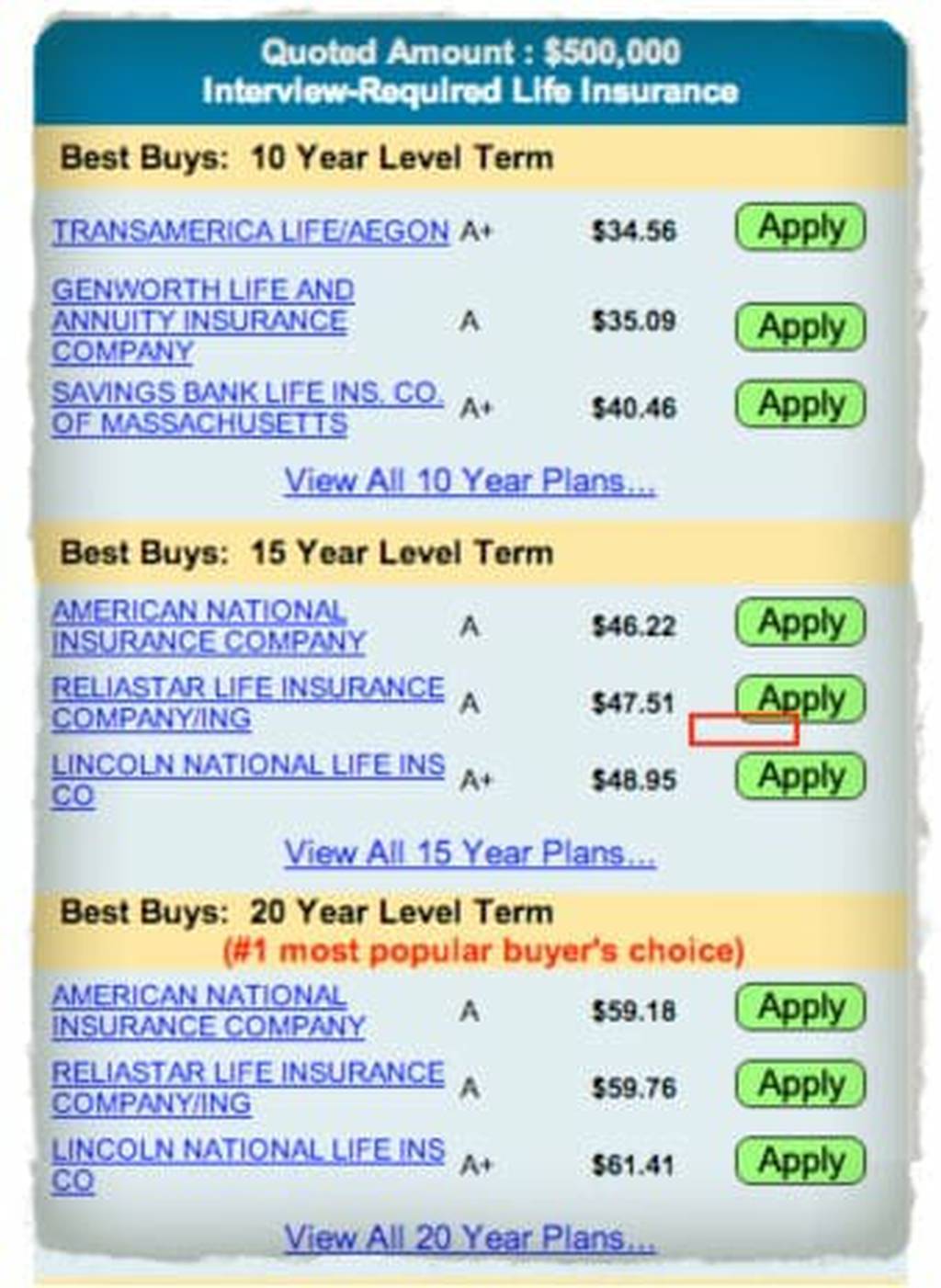

Buying too much life insurance can significantly increase your costs. Take a look at these two examples of life insurance quotes:

As you can see, the higher the payout, the higher the premium. The key is getting the life insurance you need, but no more.

2. Get Healthier

Get in shape. When I purchased my term life insurance, I got three times the insurance as a friend of mine, but I paid less. He was considered overweight, and the result was much higher premiums. If you’ve lost weight since buying life insurance, get new quotes to see if you can save some money.

While many insurance companies will focus on negative factors, such as tobacco and drug use or a history of ailments or medical issues like heart attack, some companies focus on positives instead.

Learn more: Best Insurtech Companies

3. Ask About Benefit Tiers

Once you have a number in mind, you may find that you can save money by rounding up. Premium rates for certain levels of coverage often drop when you hit certain thresholds of coverage. Paradoxically, a $500,000 policy may cost less than a $490,000 policy.

4. Reconsider the Length of Your Policy

Apply the same principle to the term length of the coverage you purchase. If your mortgage will be paid off in five years, you may not need the same huge payout for a 10-year term. As you can see from the images above, the longer the term, the more you pay.

5. Look for Hidden Fees

As you’re shopping for policies, make sure you check the hidden fees. Some insurers charge extra fees if you pay monthly rather than yearly. And insurance companies offer add-ons called riders that often offer additional coverage you don’t need. Here are a few examples–

- Accidental Death Benefit: If the insured's death is an accident, the payout is increased (often doubled).

- Waiver of Premium Rider: If the insured becomes disabled, this rider will waive the payment of premiums. This is similar to an insurance policy that pays the mortgage if the homeowner loses their job or becomes disabled.

- Disability income rider: With this rider, you'll receive a certain amount of income should you become disabled.

- Term conversion rider: Want to convert your term insurance policy into a whole or universal life policy? The term conversion rider gives you that option.

- Accelerated death benefit rider: If you become terminally ill, you can collect some of your life insurance proceeds.

Generally, these riders are a lot like the “extras” car dealerships try to sell you. Most people don’t need them, and they aren’t worth the cost.

6. Go With Term Life Insurance

Stick with term life insurance. There are circumstances when whole or universal life policies are a good option, but for most people, most of the time, term life insurance is best. And it’s a lot cheaper. Get a free online quote for term life insurance by shopping around and comparing.

7. Where to Buy

As with any product, you’ll want to shop around for the best bargain. Thankfully, most insurers make policy quotes available online. You can hop on the web and shop for a policy that suits your needs. As you’re shopping, make sure you’re comparing like policies with like terms. While one company might offer a policy with a lower premium for the same coverage, it may have exclusions that make the policy differ in important ways.

Alternatively, you can make the most of your time and efforts using a comparison tool. An aggregator will take all of your offers, line them up, and let you clearly see which one makes the best deal for you. It’s faster, easier, and smarter.

Here are some of the best companies to check out when comparison shopping.

Bestow

Bestow promises to offer you fast and affordable term life insurance without a medical exam. You can fill out the personal questions online through the application and then be approved for coverage within minutes.

Bestow is known for its reliable customer service (the Better Business Bureau gave them an A+ rating) and simplicity in a confusing business space.

If you’re looking to lower your life insurance costs, you may want to consider a simple term life insurance policy with Bestow to match your life insurance needs for your current situation.

Bestow is ideal for healthy individuals looking for a simple term life insurance policy without going through the typical process of obtaining life insurance. It offers multiple options when it comes to term length, and you won’t have to stress about going in for a medical exam.

Read: Bestow Review

Policygenius

Policygenius is an online life insurance comparison tool that allows you to shop around and browse through offers from various insurance companies. It will collect your personal information and display all options for your life insurance considerations. Unlike a typical insurance aggregator, Policygenius doesn’t just pass you off once you’ve given your personal information. It will allow you to browse through multiple life insurance policies from various providers.

Policygenius also offers helpful resources on their website to help you learn more about the different types of life insurance and how much coverage is adequate for your unique situation.

If you’re looking to save money, you can customize your life insurance coverage until you find a policy that matches your current budget. With access to many life insurance providers through Policygenius, you can shop around until you find the policy that fits you.

Read: Policygenius Review

Sproutt

Sproutt is an online life insurance company that focuses on the positives in your health thanks to its five-part Quality of Life Index. It will collect information about different aspects of your health to match you with various life insurance providers. Sproutt touts on its website that you can get life insurance coverage in 10 minutes.

It aims to connect young and healthy people (30 to 45 years old) with affordable life insurance through its comparison tool and easy-to-use website.

It’s the better option for young and healthy folks looking to save money on life insurance. It also offers a live agent as support if you have any questions about your life insurance needs or need assistance at any point. You can save money with Sproutt by shopping around until you find a policy that matches your budget.