Overall Ranking

4.5/5

Overview

4.5/5

4.5/5

3/5

4.5/5

Invest in a masterpiece and turn your portfolio into a work of art with Masterworks. It’s affordable and open to everyone. Here’s our review of this masterful creation.

Editor's Note

You can trust the integrity of our balanced, independent financial advice. We may, however, receive compensation from the issuers of some products mentioned in this article. Opinions are the author's alone. This content has not been provided by, reviewed, approved or endorsed by any advertiser, unless otherwise noted below.

People are always looking for new investment opportunities to diversify their portfolios or hedge against market risk. Many of us have even thought about delving into the lucrative world of art as an investment.

According to a 2021 report by Deloitte, 85% of wealth managers recommend investing in art, as the returns typically range from 11% to 16%. Art is a great option also because prices largely remain unaffected by market conditions. But sadly, multimillion-dollar price tags have traditionally acted as barriers for most investors - but that is not the case anymore.

Below, we discuss how a company called Masterworks is tearing down entry barriers for ordinary investors. We take an in-depth look and undertake a comprehensive review of Masterworks.

What is Masterworks?

Masterworks is an alternative investment platform that enables people to own a piece of artwork for a fraction of its market price. The idea is then to sell the painting at a later date for a higher value.

Related: Rocket Dollar Review - Easy Access to Alternative Investments

For anyone who appreciates fine art, owning these masterpieces is a dream come true. However, such art collections have exuberantly high prices, often crossing the million-dollar mark. Consequently, the price factor becomes a barrier for most investors.

However, Masterworks is changing how fine art is owned by making it available to groups of smaller investors.

How Does Masterworks Work?

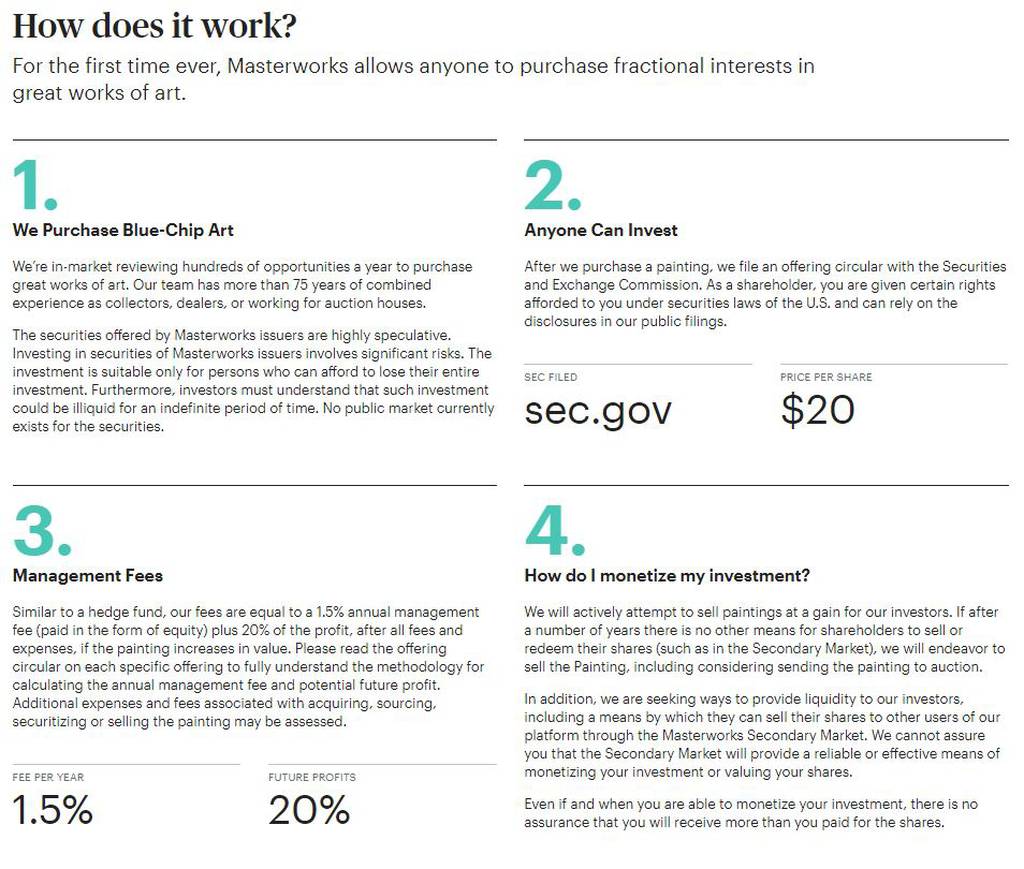

First, Masterworks uses its own capital to source and purchase high-value works of art.

Masterworks looks at historical data to determine potential price appreciation for different artwork. The company will then choose art pieces likely to continue appreciating, so their investors can net a return eventually.

Once the artwork is chosen, Masterworks buys it and registers it with the Security and Exchange Commission (SEC) to offer greater transparency to investors on its platform. After approval by the SEC, Masterworks lists the artwork on its platform.

After a piece of art is listed, the art piece’s original value is broken down into different shares. Masterworks does not have specific minimum investment amounts. Minimums vary depending on the investment offerings available.

The technology employed by Masterworks allows investors to track the price of their artwork over time. As the price appreciates, Masterworks monitors the market for an ideal time to make a sale, and the proceeds of the eventual sale are distributed amongst various stakeholders.

Valuation of the Art

Stocks and gold have fixed value by the market demand and supply conditions and the economy in general. However, art prices are solely determined by the offer a purchaser will make, as beauty lies in the eye of the beholder.

Masterworks is focused on acquiring pieces that appreciate and sell at high prices at auctions. Such pieces fetch prices in the millions and are beyond the reach of regular investors if they act alone.

Masterworks Key Features

Masterworks deals specifically in blue-chip artworks. Blue chip artworks are classified as art that continues to appreciate regardless of other market conditions. Blue-chip art can be understood as famous artwork or those pieces of art created by renowned artists and bound to have high values because of the name value attached. They fetch higher prices at auctions as serious art collectors will do almost anything to get their hands on these pieces.

The selection process is done using analytical tools and big data to ensure that all the pieces on the platform are appropriately vetted by an in-house team.

Masterworks’ team works with individual investors to determine a reasonable amount to invest. No investor can purchase over 20% shares of a particular offering.

Masterworks is currently building relationships with brokerage houses to facilitate the trading of their shares and create easy access for investors looking to buy shares in these artworks.

One of the best features the company offers is the tracking of price appreciation of the listed art piece. Though valuation is subjective, by using its team’s data, the company can provide a sound quote.

The company also plans to open a free-to-access art gallery, which will house paintings it purchased. The difference in its gallery compared to other galleries is there will be a tablet next to each painting that will track the price appreciation of each piece. Investors on the platform can view the artwork they invested in.

Masterworks Fee Structure

For any investor, understanding the fee structure of platforms plays a crucial role in determining whether or not to invest their money.

A 1.5% annual fee is charged to cover insurance, storage, and transportation. This is more or less the same as what you’d expect to pay at any other asset management company. Masterworks retains a 20% cut on any profit made from the disposal of an artwork.

It might seem to cut into your margins, but it gives peace of mind to users of the platform that Masterworks is in it to win it and will buy pieces that appreciate as the platform stands to gain from it.

The Sign-up Process

It is relatively simple to create an account on the Masterworks platform. Creating an account requires necessary information such as name, email address, phone number, etc.

After signing up, users can schedule a phone appointment with Masterworks’ team to discuss investment goals, their current investments, and Masterworks’ available offerings.

During the interview, an investor can reserve shares, or if they choose not to commit, they can still sign up to receive updates from the platform. This way, they can catch the investment wave in art whenever they want, though slightly behind investors who have reserved shares.

Invest in a masterpiece and turn your portfolio into a work of art with Masterworks. It's affordable and open to everyone. Here's our review of this masterful creation.

Pros and Cons

Track record - 9% to 39% net annualized returns

Leading research team in the art market to analyze art’s performance against other asset classes. Leading institutions like Citi use Masterworks research to help them understand art performance.

Access Masterworks art market data through its “Price Database” on its website to help you learn.

Masterworks handles the entire process of finding, purchasing and storing artwork.

Now supports a mobile app

Fine art does not have an income stream, so you should only invest thinking about capital appreciation.

If you don’t rely on Masterworks secondary market, it could take them between 3 to 10 years to sell a painting.

Hedge-fund like fees, but its net annualized returns have been between 9-39% (depending on the painting sold) after taking out its fees.

Alternatives to Masterworks

As an investment platform that deals in blue-chip art, Masterworks is one-of-a-kind with no competition, as it has created a niche. Other companies and platforms offer investment in art but at the price listed. Masterworks’ model is unique and, if successful, could change the landscape of art and investment.

However, there are other platforms known for ease of access and their range of available paintings, though they require full ownership.

Artspace

Artspace is an established platform that brings together renowned artists and buyers. Artspace deals in famous artists and artworks, though the site also features works from budding artists who could be leading the next wave of renowned art. Prices range from as low as $20 to hundreds and thousands of dollars, though most pieces are under $5,000.

Amazon Art

Amazon Art offers original and limited art ranging from $25 photographs to oil paintings worth millions of dollars. The platform allows users to browse the website using many search tools such as price, artist, style, and color. The platform has a vast collection and has something for every customer.

Who Is Masterworks For?

The first set of people targeted by Masterworks is art enthusiasts. There are scores of people out there who envy and adore art but do not have the means to buy blue-chip art. Masterworks offers art lovers who fit this category to own part of a painting, giving them the emotional pride and satisfaction they seek at barely a fraction of the cost.

Secondly, investors impressed by the returns of blue-chip art and prefer it over the stock market can turn to Masterworks as an alternative. Since the shares in each painting can be as low as $20, investors looking for opportunities in art investment can turn to Masterworks to quell their desire.

Stocks, assets, bonds, and other commodities are not everyone’s cup of tea. Some people are looking for alternative investments to put their money into. Blue-chip art offers investors looking for something distinct and exciting - a chance to invest their money.

Though generally, investment in Masterworks should not be your only one. Masterworks can be a significant investment as part of a small portion of your portfolio since it diversifies it.

Related: Ways to Invest Money

Bottom Line

Investing in art is an incredible opportunity for optimal returns and the exposure it offers to the creative world of art. Art is like any other investment as it has risk involved like other investable assets, but it provides much higher returns too.

Masterworks is at the edge of revolutionizing investment opportunities in blue-chip artwork. And by limiting the investor’s exposure to any amount they want to invest, the company has ensured that you won’t be losing millions of dollars in price fluctuations.